As a connected consumer, I can buy a book, plan a vacation, or choose a movie from any number of devices and from any location (home, office, car, or airport!). These interactions are not only convenient, they are more and more highly personalized and tailored to my likes and dislikes. We have all experienced this on Amazon and other commerce sites.

Unfortunately, we don't get this experience from many banks.

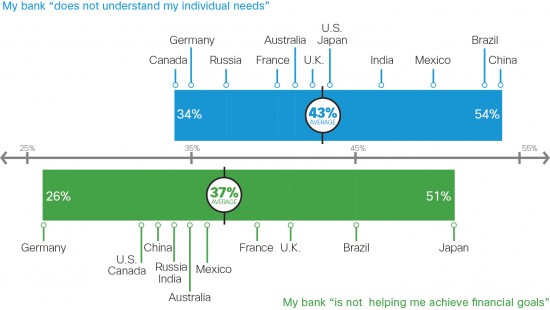

In a Cisco survey of more than 7000 smartphone users and bank customers in 12 countries, 43 percent said that their primary bank did not understand their individual needs. Bank customers in China (54 percent), Brazil (52 percent), Mexico (49 percent), and India (46 percent) felt even more disconnected (see chart below).

Source: Cisco Consulting Services, 2015

Source: Cisco Consulting Services, 2015

That frustration puts banks in an increasingly precarious position: nearly one in four bank customers intend to choose another provider for their next financial product or service. Four out of five would trust a non-bank - such as Apple, PayPal, or a retailer - to handle their banking needs. These disruptive competitors succeed where traditional banks fail: by engaging customers with convenient transactions and relevant, real-time, personalized services.

I am convinced, however, that banks now have an exciting opportunity to drive their own disruption during this time of sweeping change. Brett King, who is the CEO of the mobile bankMovenand recently joined a podcast produced by our team, sees the smartphone as driving "the most dramatic shift in banking behavior that we've ever seen."

I agree.

The opportunity goes beyond just the online-only banking players. In a recent blog, I spoke of how even market incumbents can gain the agility and rapid innovation of startups. That includes more traditional banks. With a foundation of digital business transformation in place, banks can provide the kinds of mobile, personalized, and convenient services that customers are used to receiving elsewhere. At the same time, they can leverage their core strengths - scale, troves of customer data, physical branches, and expert financial advice - to create a value proposition that their online-only competitors cannot match.

In our research study, we tested five Internet of Everything (IoE)-enabled concepts banks can implement to deliver better advice (virtual financial advice, virtual mortgage advice, automated investment advice) and more valuable mobile services (branch recognition, mobile payments). These concepts resonated with customers globally:75 percent of all respondents would move their money to a new bank for one or more of these services. In emerging markets, respondents weretwice as likelyto move their money.

It is essential that banks first lay the foundation through digital transformation. To create frictionless interactions with their customers, banks must move from an archaic, paper-based approach to fully digitized business processes. Moreover, they must gain the analytics capabilities that will enable them to turn torrents of data into actionable customer insights.

The five concepts we tested are just the beginning of what is possible in banking, especially considering the rise of emerging technologies such as augmented reality and wearables. For now, however, we are able to project that by implementing just those five tested concepts, banks can realize bottom-line profit increases ranging from 5.3 percent in Germany to 15.2 percent in China.

As I see it, banks can step up to an exciting new era in whichtheyare the disruptors - offering real-time expert advice and fast, convenient service to more customers than ever before, while leveraging their scale and combining the best of mobile and physical-branch interactions.

That value proposition will satisfy even the most demanding, connected customers.

To learn more about the exciting opportunities for banks that embrace digital transformation, please listen to ourpodcast, featuring Paul Jameson from our team, along with Brett King, CEO of Moven, a mobile-only bank, and Jerry Silva, research director, global retail banking, IDC Financial Insights.

Горячие метки:

3. Инновации

Internet of Things (IoT)

Internet of Everything (IOE)

Цифровая трансформация

Банковское дело

Financial Services Industry (FSI)

Cisco Consulting Services

data analytics

hyper-relevance

Горячие метки:

3. Инновации

Internet of Things (IoT)

Internet of Everything (IOE)

Цифровая трансформация

Банковское дело

Financial Services Industry (FSI)

Cisco Consulting Services

data analytics

hyper-relevance