J.D. Power announced last week the results of its 2022 US Consumer Lending Survey. The survey found that 38% of vulnerable consumers -- defined as consumers who have a difficult time making necessary payments, such as bills -- have turned to personal loans to manage their debt.

Additionally, 47% of consumers said an ad influenced them to get a personal loan, and 61% said they would use their lender again. According to J.D. Power, the top three reasons consumers have utilized a personal loan are: debt consolidation, lower interest rates, and lower monthly payments.

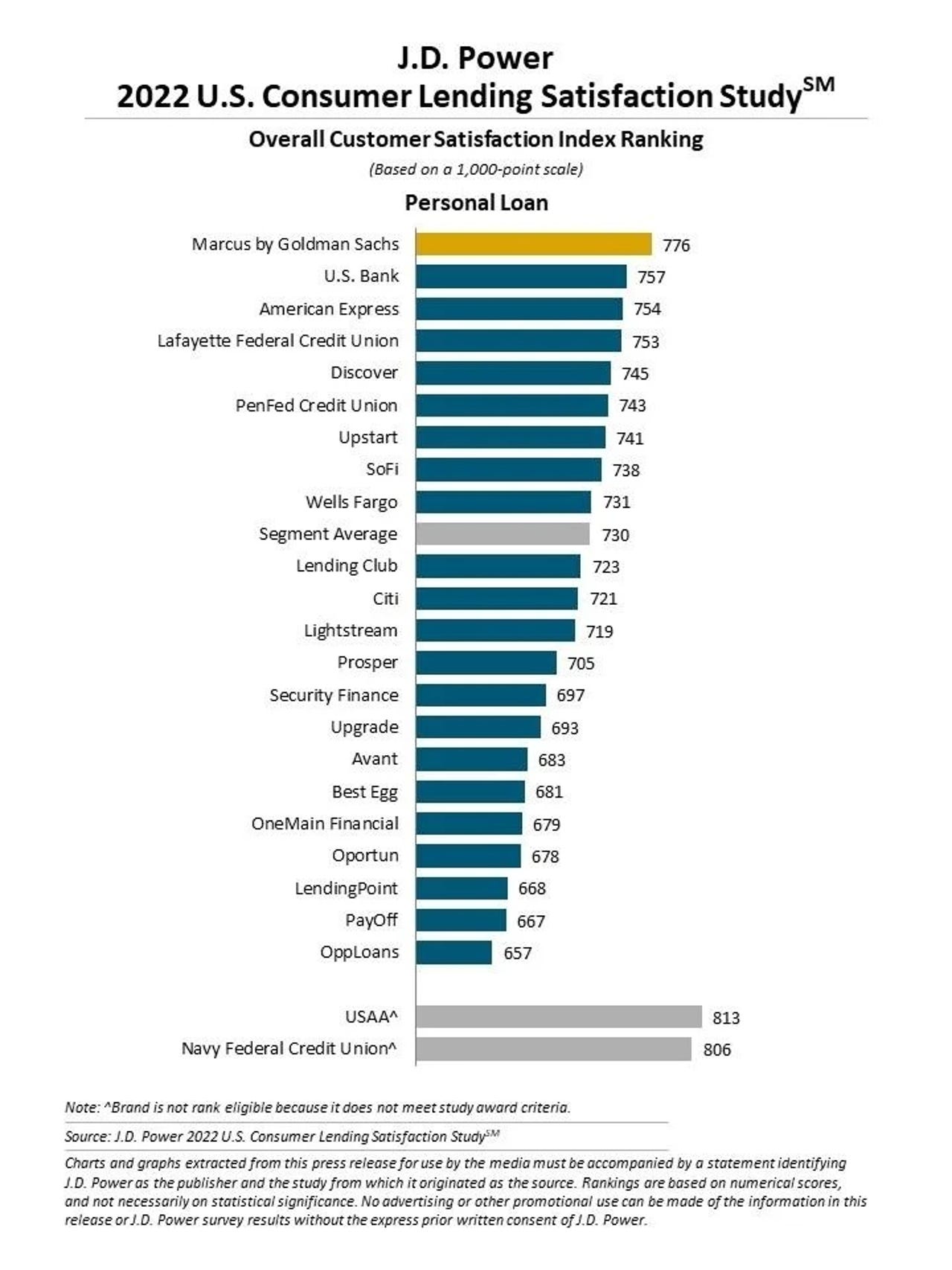

The study was based on responses from 5,269 personal loan customers and was fielded from January through March 2022. It focused on four main components: application process, loan management, shopping, and loan terms. The top three lenders in terms of customer satisfaction were Marcus by Goldmen Sachs, followed by US Bank and American Express.

J.D. Power's 2022 Consumer Lending Satisfaction Study results.

If a consumer is struggling with credit card debt, personal loans present an opportunity to consolidate the debt and get better terms. Personal loans have lower interest rates than credit cards, so they can help consumers save money from interest charges as they pay off the loan.

"If someone has a lot of credit card debt, a personal loan makes sense. It may not be the best rate out there, but... if you're paying 30%, 35% [annual percentage rate] on a credit card and you can lower it to 15%, it's still not the best but it's better," Craig Martin, Managing Director and Global Head of Wealth and Lending Intelligence at J.D. Power, toldZDNet.

These apps help you make a large purchase and pay it off in small installments. Here are our six favorites.

Read nowMany lenders had stopped lending at the start of the pandemic. But as consumers are facing greater financial stress and some of the unknowns that lenders faced at the beginning of the pandemic have cleared up, lenders are offering more loans.

"[Lenders'] fear about what would come in terms of credit exposure [at the start of the pandemic] -- there were a lot of unknowns. So they were shutting down their lending altogether, and I think clearly a lot of the negative scenarios didn't play out... Now we've got a new set of unknowns coming, but I think that it's a more manageable environment," Martin said.

J.D. Power found that competitive rates, easy access, and greater options led to an increase in personal loans. Another reason personal loans have experienced growth is that younger generations are less interested in credit cards.

"Consumers, especially younger consumers, have started to shy away from some of the other debt products that are out there, like credit cards, which oftentimes are designed as a double-edged sword. They can be very helpful and give you access to things like a line of credit, but there's a lot of negative that comes with it. And I think a fixed personal loan can be simpler," Martin said.

There are a number of factors consumers should think about when considering a financial product of any kind. For instance, interest rates. The Federal Reserve voted to raise federal interest rates in early May as a way to combat inflation. And as inflation is still well above the 2% target, further increases could come.

Whether it's your first credit card or you're simply trying to rebuild credit, these are the cards for you.

Read nowWith the cost of living increasing, many are left wondering if personal loans are a viable choice for making ends meet. As long as consumers are using financial products responsibly, Martin said, they're still a good tool to use.

"As the interest rate rises, it's going to actually make personal loans more attractive. Think about the heart of what a personal loan is for; according to our respondents, it's to consolidate debt and pay things off. So if inflation is going up, people are looking to make better financial decisions. People who are challenged financially -- it's going to be a product that's going to be needed," he said.

An important aspect of any financial product is having the financial literacy to use it best. It's growing increasingly important for lenders and financial institutions to support the financial literacy of their clients. J.D. Power has found in other studies that when a customer feels better supported by their lender, they experience greater satisfaction and higher loyalty.

Also:Direct or digital banks lead the way with customer satisfaction: J.D. Power study

"We're finding a lot of these companies are layering in financial education -- [concepts like] "how do you budget, how do you make good choices, how do you earn credit" -- so that they can lower the interest rates that they're getting in the future," Martin said.

"I think of it as organizations moving away from being product-centric to being consumer-centric. Not only is it about how [the product] meets the needs of the customer, but how it addresses the long-term systemic problems the customer may have to help them get to a better position is critical as well."

Another key finding of the study is the role advertising plays in a consumer's decision to apply for a loan. According to the survey, 47% of consumers indicated that an ad made them consider applying.

If what a consumer expects when it comes to applying for a loan lines up with the information they've been given around the financial product, they're likely to experience higher levels of satisfaction. According to J.D. Power, a major part of the satisfaction customers experience lies in managing consumer expectations, the communication from the firm, and the ease and speed of the application process.

"A lot of what's important for a good experience occurs after you've gotten their attention," Martin said. "It's finding the right balance between what the customers think they'll get and then what they actually get."

Once a firm has a consumer's attention, it's critical that they follow through on their promise. Is it an easy approval process? Has the firm communicated well the terms of the loan? After the consumer is approved, is it easy for them to get help if they run into problems or questions?

"So much of it is communication. When we talk about customer experience, expectations match the experience. So if I expect a lot and get very little, I'm really unhappy, and vice versa," Martin said.

Горячие метки:

1. Финансы

Банковское дело

Горячие метки:

1. Финансы

Банковское дело