Image: Hinterhaus Productions/GETTY

Image: Hinterhaus Productions/GETTY Despite a combination of inflation, the Fed's interest rate hike, recent hiring freezes by IT giants and widespread layoffs in the tech sector, it would seem tech workers are pretty confident about their near term prospects.

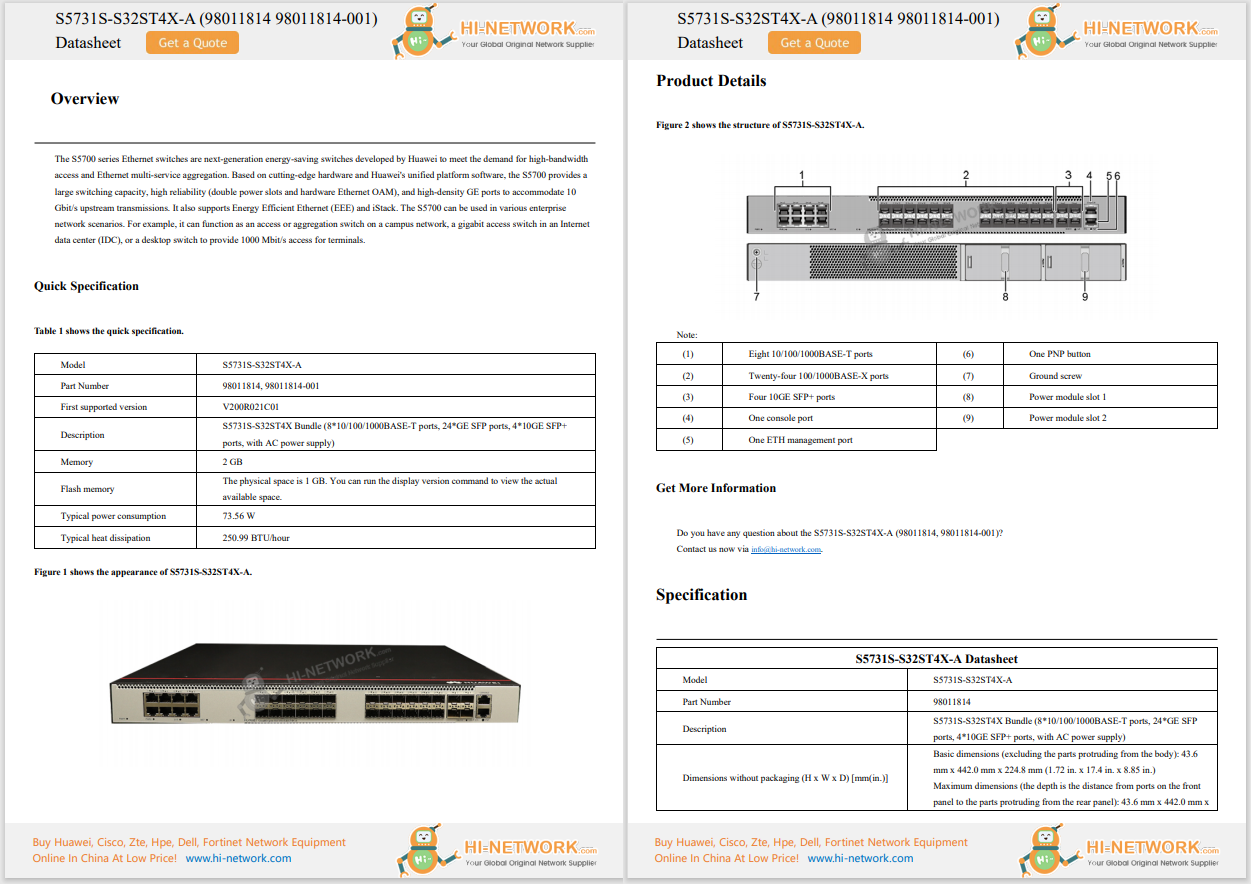

Over half (57.1%) of employees surveyed are planning on looking for a new job in the next six months, and 22.2% are considering it. Part of the reason could be that workers still just about have the upper hand in the job market, even though some fear that situation is about to change.

"This could indicate, despite some employees fearing they will lose power in this uncertain job market, that they're confident in landing a better role in the near future -or are willing to try," according to tech job search platform Hired's 2022 salaries report.

SEE:Four ways to get noticed in the changing world of work

On top of this, 67% report they'd start looking for other work if their employer knocked back a pay rise request in the next six months. A further 23% would stay if declined a raise, but would push for other benefits such as stock options or more paid time off (PTO). And it might still be a jobseeker's market in 2022, as candidates have more interview requests on average to choose from versus the number of candidates vying for a position.

The apparent willingness to leave a job suggests tech sector workers aren't too concerned by recent layoffs at US tech firms. According to Crunchbase's lay-off tracker, as of August 9, US tech firms had laid off 41,000 workers since the beginning of 2022.

While that is a large number, it's smaller than jobs growth in the US tech sector in 2022. CompTIA, the IT industry association, in September reported that US tech industry employment had increased by 175,700 jobs in 2022.

Across all sectors, the unemployment rate was 3.7%, according to the US Bureau of Labor Statistics' (BLS) August 2022 figures.

Regarding pay, tech analyst Gartner's recent survey of CFOs and CEOs suggested executives want to restrict pay increases: 70% said they'd only give pay rises to top performers in select markets; and a quarter would limit pay rises to top performers in the highest inflation areas. But the survey wasn't specific to the tech sector.

Hired found that 51% of tech workers expect their salary will increase by January 2023, while only 5% expect their salary to decrease by then.

The firm says its data is based on "more than 907,000 interview requests across over 47,750 active positions facilitated through our marketplace from January 2019 through June 2022 (Q2 2022)." The survey includes data from the US, Canada, and UK.

In 2022, 61.7% of tech workers were employed in 'remote-first' firms, while 30% did hybrid work and 7.9% were fully in the office. About 56% of tech workers were satisfied with their employer's current work model and want to keep the status quo.

"When asked if candidates would be willing to return to working in the office if it meant greater job security, over half (54.2%) of candidates stated 'yes', but they would start looking for other jobs with more flexible remote work options immediately," Hired notes in the report.

A further 29% said they'd rather quit, while only 16.8% said they'd return to the office stay with their current company.

That share of remote work in the tech sector is very different to the rest of the US labor market, in which just 6.5% teleworked in August, according to BLS data.

Average salaries for remote tech workers climbed to$162,950 and tracked very close to average salaries in Tier 1 cities such as New York and San Francisco and Tier 2 cities such as Boston and LA, which were$167,000 and$162,000, respectively.

SEE:Digital transformation: Trends and insights for success

The highest growth in salaries, including non-US cities, was seen in Philadelphia (11.9%), Dallas (11.28%), Denver (10.59%), Toronto (9.05%), and London (8.15%).

Cities with the top average salaries include the usual suspects: San Francisco Bay Area was the top at$174,063, followed by Seattle ($168,069), New York ($161,128), Boston ($158,548), and Austin ($157,612).

The top-earning role was engineering management with an average salary of$196,000, followed by software engineers ($160,469), while DevOps, product management and design had average salaries between$153,000 and$158,000.

Hired's snapshot of salary trends by industry is interesting. In the US, the highest paying industries in 2021 -HR, cleantech, and digital payments -were supplanted by real estate, social networking, and e-commerce.

Industries with the highest salary growth between 2021 and 2022 in the US were social networking (9.5%), automotive (9.0%), real estate/property management (8.6%). In Canada, the fastest growth in salaries were in enterprise software (19.8%), financial services (12.7%), and education (11.64%). In the UK, the fastest-growing salaries were in automotive (27.4%), energy (13.9%), and e-commerce (11.2%).

Горячие метки:

По вопросам бизнеса

Компания-разработчик

Горячие метки:

По вопросам бизнеса

Компания-разработчик