Intel published its third quarter financial results on Thursday, beating market expectations as enterprise and IOT business recovered from the economic impacts of the Covid-19 pandemic.

The chipmaker achieved all-time record revenue in its Internet of Things Group (IOTG) and record third-quarter revenue in the Data Center Group (DCG) and Mobileye businesses. However, PC business was down due to component shortages.

Intel

Intel Intel's non-GAAP earnings per share came to$1.71 on GAAP revenue of$19.2 billion, up 5% year-over-year.

Analysts were expecting earnings of$1.11 on revenue of$18.24 billion.

"Q3 shone an even greater spotlight on the global demand for semiconductors, where Intel has the unique breadth and scale to lead," CEO Pat Gelsinger said in a statement. "Our focus on execution continued as we started delivering on our IDM 2.0 commitments. We broke ground on new fabs, shared our accelerated path to regain process performance leadership, and unveiled our most dramatic architectural innovations in a decade. We also announced major customer wins across every part of our business. We are still in the early stages of our journey, but I see the enormous opportunity ahead, and I couldn't be prouder of the progress we are making towards that opportunity."

In a conference call Thursday, Gelsinger laid out four growth areas in which Intel plans to invest: networking, graphics, autonomous vehicles and foundry. As it pursues those businesses, he said Intel has a long-term CAGR of 10% to 12%.

"These four new growth businesses... have massive growth potential for us," Gelsinger said. "Large favorable markets that are looking for leadership, logic capabilities that Intel is uniquely positioned to supply into the industry."

While investments in these areas will impact near-term margins, he continued, "these are great investments in large, growing, favorable markets that very few companies have even the opportunity to participate in, and we bring such massive assets to them."

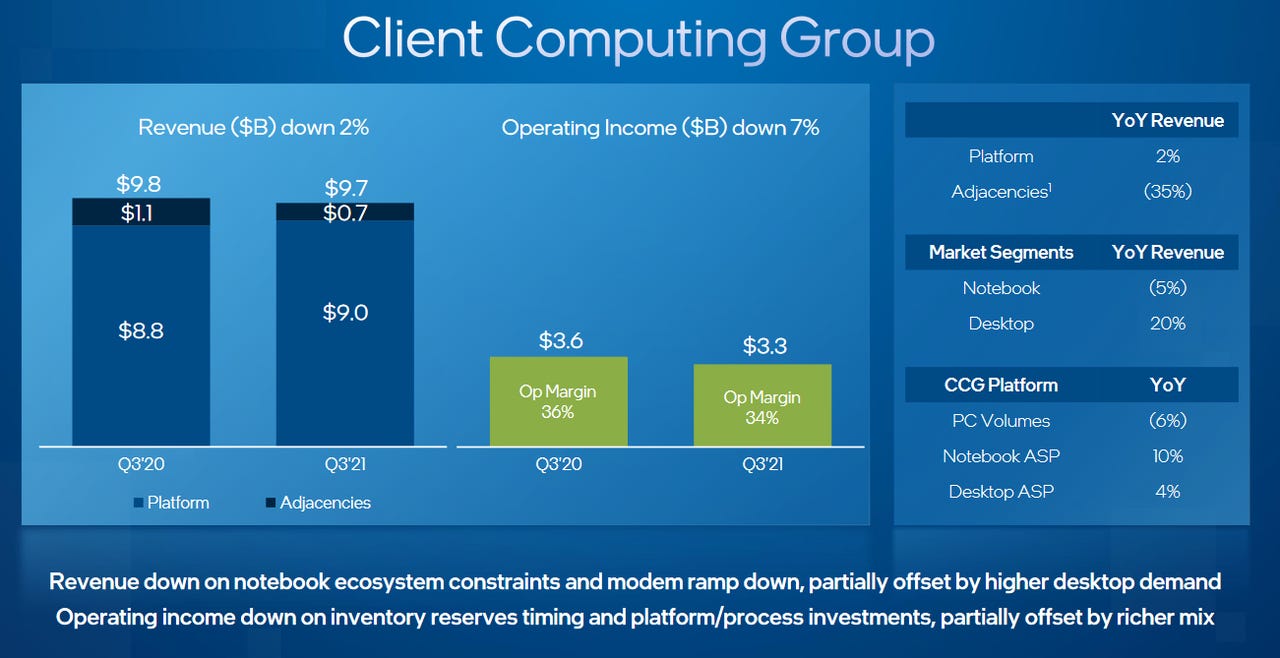

In Q3, Intel's Client Computing Group (its PC business) brought in revenues of$9.7 billion, down 2% year-over-year. Business in this segment was down due to lower notebook volumes due to component shortages. That was partially offset by higher average selling prices and strength in desktop sales.

Revenue from the Data Center Group in Q3 came to$6.5 billion, up 10%. Revenue from cloud service providers was down 20 percent year-over-year, but sales from enterprise and government customers was up 70 percent.

Intel's memory business (NSG) brought in Q3 revenue of$1.1 billion, down 4%.

The Internet of Things Group achieved revenues of$1 billion, up 54% over the year prior. Mobileye brought in$326 million, up 39%.

Intel's PSG (programmable solutions group) brought in$478 million, up 16%.

For the fourth quarter, Intel is giving an outlook of$19.2 billion in revenue. Intel is raising its full-year 2021 non-GAAP EPS to$5.28. Its FY 2021 outlook is$77.7 billion.

Meanwhile, Intel CFO George Davis announced plans to retire in May 2022.

Горячие метки:

Технологии и оборудование

Вычислительная техника и оборудование

Горячие метки:

Технологии и оборудование

Вычислительная техника и оборудование