Source: Mint

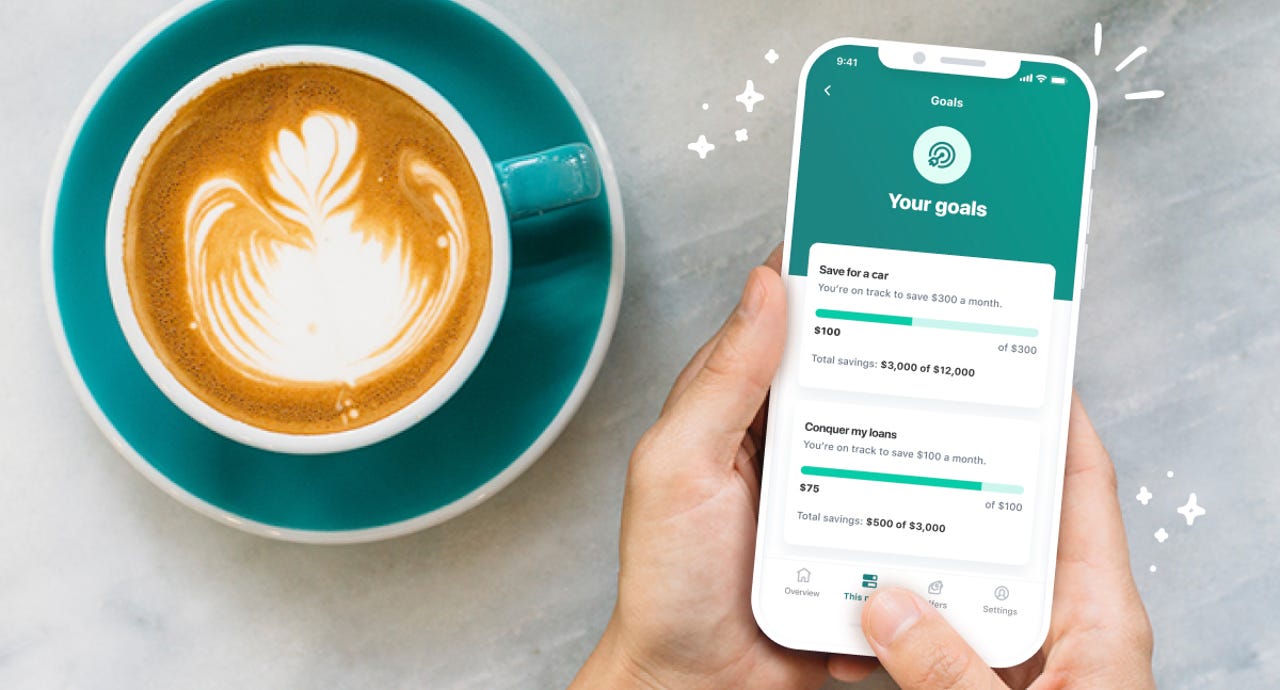

Source: Mint Mint, a personal finance app, is offering users simple tools to help manage their finances during these financially stressful times. In addition to budgeting, the app is offering users two new features: Subscription tracking and bill payment negotiations.

Mint is a simple to use app and provides users with a free way to better manage their finances. Users connect all of their accounts -- including credit cards, loans, subscriptions, and investments -- to the Mint app so that everything is in one, accessible place.

The app will track spending, income, what bills are due, and what subscriptions you're paying, among other transactions. It's an intuitive way to monitor cash flow in one place. Users get alerts about when bill payments are due and can set personalized budgets to help save money.

Consumers could use an edge during a rapidly evolving and financially stressful environment created by the storm of rising gas prices, an ongoing global pandemic, and inflation growing to 8.5% in March. Mint seeks to give it to them.

"We're still in the midst of the inflation journey, so there's still a lot of uncertainty and unknowns about where this is going, but I think the most important thing is to have as much insight and awareness as possible into how [consumers are] spending money," Varun Krishna, senior vice president and head of consumer finance of Mint at Intuit toldZDNet.

According to Krishna, consumers should consider if the purchase is a short-term discretionary cost or if it's a long-term purchase that will support them in the future. Understanding where your money is going is the first step to creating better financial habits, he said.

"Using products that help you understand how your money is being spent is an amazing tool to manage inflation because you understand, 'okay, I'm spending this much more month over month on gas'," Krishna said.

The average consumer doesn't necessarily track how much of an impact everyday purchases such as gas can have on their finances. But using a budgeting tool like Mint can show them that impact month over month or even week over week, he said.

Mint gives consumers an edge over simply tracking transactions on their bank account by clearly showing them things like how much more they've spent on gas or other purchases over the past month.

Once users connect their accounts to Mint, the app will intuitively tell them what transactions they are making and where their spending is increasing or decreasing. It will also let them create personalized budgets to focus on certain areas where they'd like to save money.

"[The app will] tell you, 'hey, here's how much you spend in each area, here's your subscription costs that increased, by the way, could you negotiate your bills,' if you want to go deeper you could create a budget and say, 'I actually want to spend less on going to the bar,' and so you can create a specific budget to track a specific behavior," Krishna said.

It might seem obvious, but simply knowing where your money is going and figuring out where you can spend less are great and easy ways to support personal finances in the face of rising prices for everyday items.

"The best thing we can do is just be as aware as possible of what we're doing and really understand the consequences of the decisions that we make when it comes to money," Krishna said.

In addition to budgeting, what can consumers do to better support themselves in the face of so many financially stressful forces like stagnating income and The Great Resignation?

"[Finance] is a game of inches, of little steps. It doesn't take some massive change; just inch by inch, work your way up," Krishna said. According to him, the best thing to do is to be aware of where your money is going, seek out consumer-centric products, and to follow these simple tips:

Consumers should look for tools and services that put their needs first. Some financial products are built on predatory systems like overdraft and maintenance fees or ridiculously high-interest rates on payday loans that some consumers may need just to make ends meet.

However, lately, there's been an influx in financial services companies looking to support the financial wellness of their clients, from big banks like Bank of America to payment processors like Visa and FinTechs, including Robinhood and SoLo Funds. But some are doing that better than others, and there is still plenty of room for improvement.

Also:Banks aren't adequately supporting customers through financial hardship: J.D. Power study

"A lot of the financial system, they want you to spend money, they want you to take the dealer-offered financing, they want you to overdraft and pay fees. I think the need for an unbiased product that can just look out for you and your interests and try to get you to avoid debt, try to get you to save money, that also can forgive you and say, 'hey, you know what? You do have a little bit saved up; you do deserve a vacation, go enjoy yourself.' Because at some point, people need to be able to enjoy their lives," Krishna said.

That's one of the core motivating factors behind Mint, to be a product that truly supports consumers. And a lot of times, it's underserved communities that suffer the most from antiquated or predatory practices.

In addition to supporting the financial wellness of its users, Mint is also working to bolster the financial literacy of underserved communities. Many underrepresented communities don't have access to banking and financial resources and are subject to predatory practices like unfavorable rates and fees.

So in partnership with EVERFI, Mint has created Prosperity Hubs and the Prosperity Hub School District program to bring the educational resources of Mint to schools. The program teaches personal finances to students, covering basics such as understanding a credit score, budgeting, and net worth, among other topics.

Also:Juni Learning, Bloom are offering a free investing course for students

"We focus on communities that have diverse student populations. Part of the reason is it's the underserved communities that I think are unfortunately the hardest hit in terms of lack of financial literacy," Krishna said. The Prosperity Hub School District program has helped nearly 1.2 million students.

Financial literacy has grown increasingly important as consumers use more financial products and turn frequently to digital banking solutions. As the needs of consumers evolve, so too must the way we approach financial wellness.

April is Financial Literacy Month. ZDNet gives you the finance background you need to help you better understand, and manage, your personal finances, from credit cards and banking to taxes and even cryptocurrencies.

Read now"You have Gen Z navigating careers during a pandemic, with lower income and a much more difficult circumstance starting to work. At the same time, you have more and more millennials wanting to become creators. It's a new type of job market which is so exciting, but I think this creates a need for further education," Krishna said.

FinTechs and banks building new financial technologies should feel obligated to teach their users about best practices in a changing financial environment and how users can better support their personal finances. It should no longer be up to the individual to seek out financial literacy resources.

"We all have a moral obligation to help our consumers. We've evolved to a place now where people have their own objectives and goals, and I think there's a way to educate people that doesn't require them to always take the initiative," Krishna said.

The financial system, he said, has ignored the problem of financial literacy for so long that it's now up to the FinTechs and banks that are creating new financial products to build a more consumer-centric environment for consumers to thrive in. Financial literacy shouldn't be hard to obtain but rather be baked into these products so that the users can easily make better-informed decisions about their finances.

Also: Everyone from Gen Z to Boomers could use more financial education: NFEC study

Krishna said consumers shouldn't need in-depth knowledge to understand their finances. The products they use should intuitively deliver this information to consumers without having them seek it out. Financial literacy shouldn't require any extra work. "To me, I envision a world where finance is much more autonomous and implicit, and it's working on your behalf," he said.

"I think that's the advanced state of financial literacy. Beyond just us doing more to educate consumers and building their knowledge and awareness, but to actually just build products that make their financial lives better. Products that automatically drive [consumers] toward prosperity without having to think about it. I see that as a great vision toward where financial literacy could grow," Krishna said.

Горячие метки:

1. Финансы

Горячие метки:

1. Финансы