Image: ACCC

Image: ACCC Users know that telco coverage maps are unreliable at the best of times, but the Australian Competition and Consumer Commission (ACCC) wants to change that.

At the heart of the problem is telcos interpreting record keeping rules over coverage in different ways. Optus and TPG mostly do it with predicted outdoor coverage on a standard handset, while Telstra predicts coverage based on having an external antenna.

The telcos need to use prediction because objects such as buildings, walls, and fallen trees, can get between the user and the tower, lowering the signal received. Each telco also has differing inputs and assumptions in its prediction.

The difference between the two approaches is best shown by how Optus included in its 4G coverage for 2021 a 700Mhz coverage map that used the external antenna measurement instead of outdoor coverage. If the numbers from Optus were taken on face value, the telco would have increased its total national geographic 4G coverage in a single year by 57 percentage points, with remote coverage more than doubling, and very remote coverage tripling.

"The results for 2021 should be treated with caution," the ACCC warned in its Mobile Infrastructure Report 2021.

The differences in coverage information was particularly important for those outside the major cities, the report said, where network choice was limited, and proper information could help users make informed choices and improve competition.

"Many regional consumers have a limited choice of networks and need to know if they will have coverage at home, on properties or along regular transit corridors. This is for both connection and for safety purposes," the ACCC said.

"As such, industry should collaborate on the development of a common set of assumptions for predicting coverage.

"In the absence of industry-led process, it may be necessary for the government and regulators to prescribe these assumptions to address the issue."

While Telstra might be playing silly buggers with its coverage maps, one area where it continues to outpace the other major carriers is in the number of mobile sites.

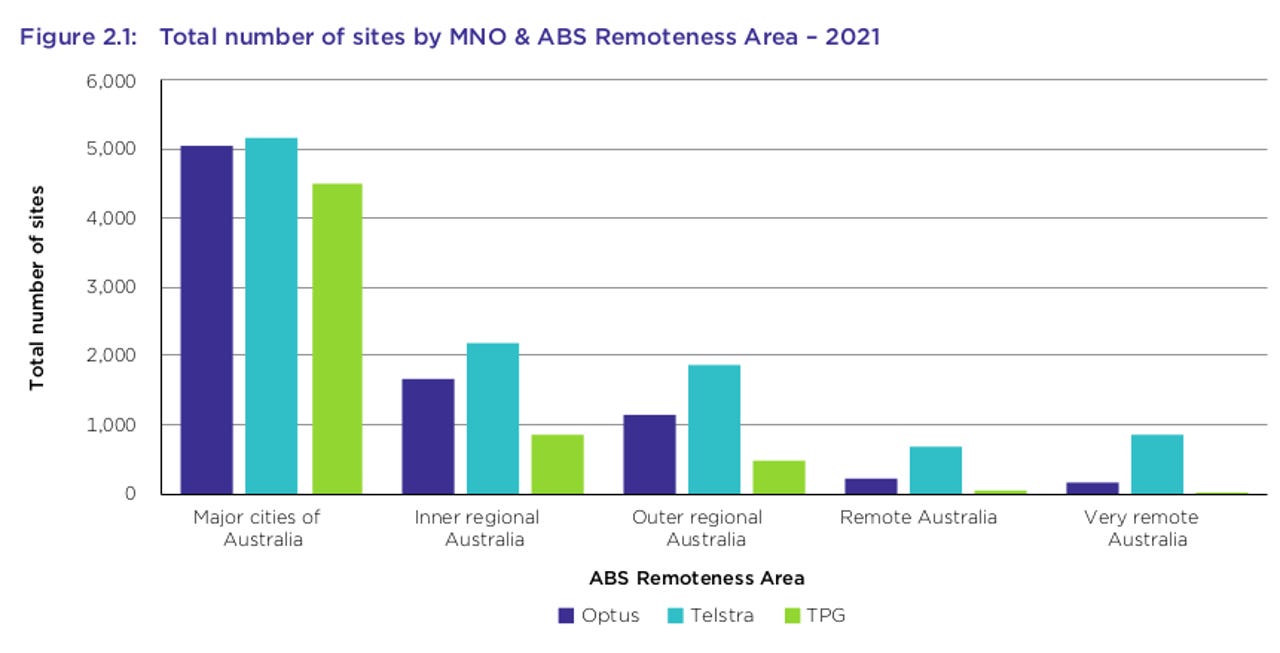

At the end of January, Telstra has 10,766 sites, followed by Optus at 8,238, and TPG at 5,892 sites. In major cities, Telstra has 5,165 sites, Optus has 5,037 sites, and TPG has 4,503 sites, but outside those cities is where the difference becomes stark, as TPG has 1,369 sites outside major cities, Optus has 3,201 sites, and Telstra has the bulk of its total sites outside of cities, reporting 5,601 sites.

The report showed the discrepancy in funding choices under the mobile blackspot program, with Telstra having 735 sites receive co-funding, Optus gaining 126 sites, and TPG getting cash for 60 sites.

Simply having sites is not the entire coverage story though, as telcos can share towers and sites. The report said 87% of TPG sites are collocated with another telco, Optus has a collocation rate of 73%, and Telstra has just under 35% of its sites collocated.

The most common combination was all three telcos on one site at 2,469, closely followed by TPG and Optus together on 2,447 sites, Optus and Telstra shared 1,070 sites, and TPG and Telstra were collocated at 221 sites. On their own, Telstra, Optus, and TPG have 7,006, 2,252, and 755 sites respectively.

Alongside the report, the ACCC also released a data set of each telco's mobile sites and coverage.

On Tuesday, Optus said it was trialling its Ericsson standalone 5G network with Oppo X3 Pro 5G handsets. The telco said it had the first customers in Australia connecting to multi-band standalone network across the 3500MHz, 2300MHz, and 2100Mhz bands.

In the past week, TPG has laid claim to the world's longest 5G voice and video call, with two phones situated 74km from the tower at Mt England in Queensland completing the call. On Wednesday, TPG launched its SD-WAN offering alongside Fortinet.

Горячие метки:

Технологии и оборудование

1. Смартфоны

Горячие метки:

Технологии и оборудование

1. Смартфоны