HP reported better-than-expected fourth quarter earnings due to strong demand for its Windows PCs amid hybrid work.

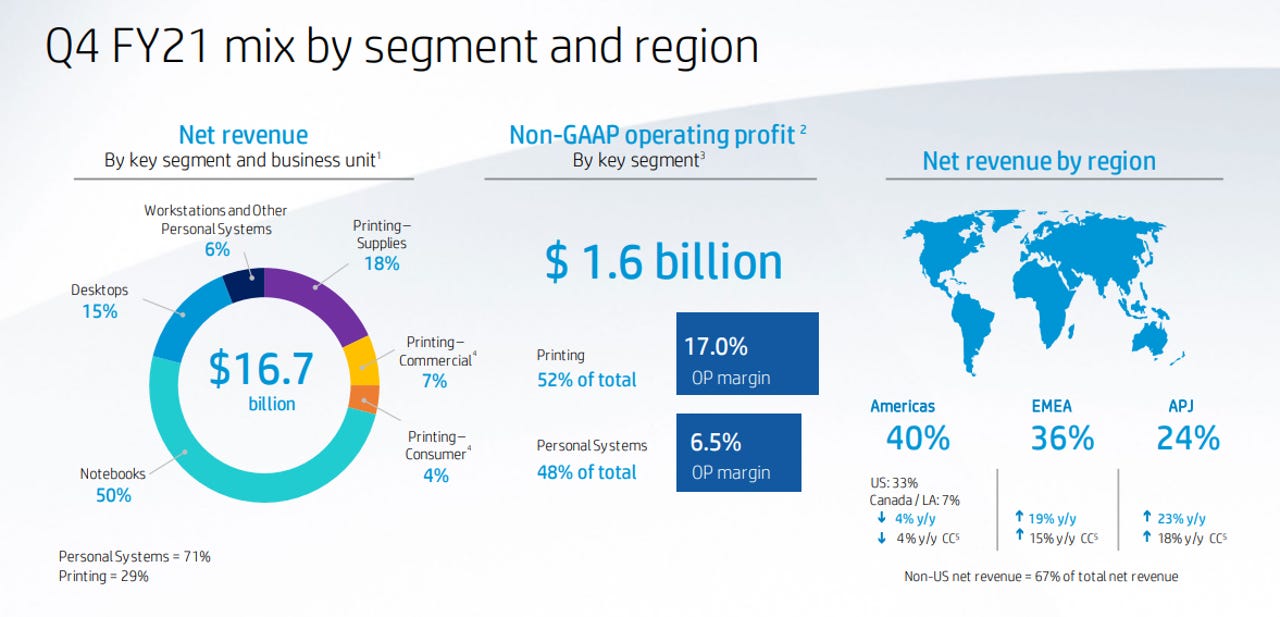

The company reported fourth quarter revenue of$16.7 billion, up 9.3% from a year ago, with earnings of$3.1 billion, or$2.71 a share. Non-GAAP earnings for the fourth quarter were 94 cents a share.

Wall Street was expecting HP to report fourth quarter revenue of$15.4 billion with non-GAAP earnings of 88 cents a share.

For fiscal 2021, HP delivered revenue of$63.5 billion, up 12.1% from the previous year, with earnings of$6.5 billion, or$5.33 a share.

CEO Enrique Lores said HP saw strong demand in the fourth quarter and is well positioned with its portfolio of hardware, software, and subscriptions. HP recently outlined its multi-year growth plans at an investor meeting.

On a conference call with analysts, Lores said:

The progress we are making against our priorities is creating a more growth-oriented portfolio. At our Analyst Day, I said that we expect our 5 key growth areas to grow double digits and generate over$10 billion in revenue in fiscal '22. These businesses collectively grew 12% this quarter. This includes more than 30% growth for our Instant Ink business, as well as more than 20% growth for our industrial graphics portfolio. We see our key growth areas becoming a bigger part of overall revenue and profit mix moving forward. We are driving this growth even as we continue to navigate a complex and dynamic operational environment that includes robust demand and persistent supply constraints. The actions we have been taking to mitigate industry-wide headwinds are paying off. There is no quick fix, but we are strengthening our operational execution and making continued progress quarter-by-quarter.

PC sales drove HP's results. Personal systems revenue in the fourth quarter was$11.8 billion, up 13%. Consumer PC sales fell 3% in the quarter, and commercial revenue surged 25%. Total units fell 9% in the fourth quarter. Lores added:

A big part of our success is improved mix, we are driving given our leadership in the commercial PC market. And as more offices reopened, we led a shift toward Windows-based commercial products where we saw the strongest demand and highest profitability. We continue to see significantly elevated order backlog. As I shared last month, we expect component shortages to persist in at least the first half of '22.

For the printing business, HP delivered revenue of$4.9 billion, up 1% from a year ago. Both consumer and commercial units fell double digits.

As for the outlook, HP projected first quarter non-GAAP earnings of 99 cents a share to$1.05 a share. Wall Street was looking for first quarter non-GAAP earnings of 94 cents a share. For fiscal 2022, HP projected non-GAAP earnings between$4.07 a share and$4.27 a share. HP is projecting fiscal 2022 cash flow of at least$4.5 billion.

Горячие метки:

Технологии и оборудование

Оборудование и аксессуары

Горячие метки:

Технологии и оборудование

Оборудование и аксессуары