The sale of PCs in the third quarter of the year fell nearly 20% compared to a year ago, the largest drop in decades and the fourth straight quarter of year-over-year declines, according to preliminary research by two analyst firms.

The surge in PC sales created by the pandemic and the tremendous uptick in hybrid and remote work is over and no longer adding to computer sales. Back-to-school PC purchases also showed "disappointing results, despite massive promotions and price drops, due to a lack of need as many consumers had purchased new PCs in the last two years," according to Mikako Kitagawa, a director analyst at Gartner.

On the business side, geopolitical upheavals, such as the war in Ukraine, and economic uncertainties "led to more selective IT spending, and PCs were not at the top of the priority list," Kitagawa added.

Globally, PC sales fell a whopping 19.5% in the third quarter of 2022 - the largest decline since Gartner began tracking sales in the mid-1990s. Research firm IDC pegged the year-over-year drop at 15%, and echoed Gartner's take on the issues effecting sales, according the firm's Worldwide Tracker.

"During the peak of the pandemic, many consumers, schools, and business sought new PCs and that surge has been largely fulfilled," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers.

The US PC market dropped 17.3% in the third quarter of 2022, the fifth consecutive quarter of year-over-year shipment decline. Slow laptop sales drove the overall US market down, while desktop sales showed modest growth - driven by pent-up demand among businesses as well as the public sector, according to Gartner.

"Inflation is the biggest concern in the US. market, but smaller businesses are showing relative optimism about macroeconomic conditions," Kitagawa said. "While laptop demand among large enterprises sharply decreased in the third quarter of 2022, small and midsize businesses did not show as steep of a drop."

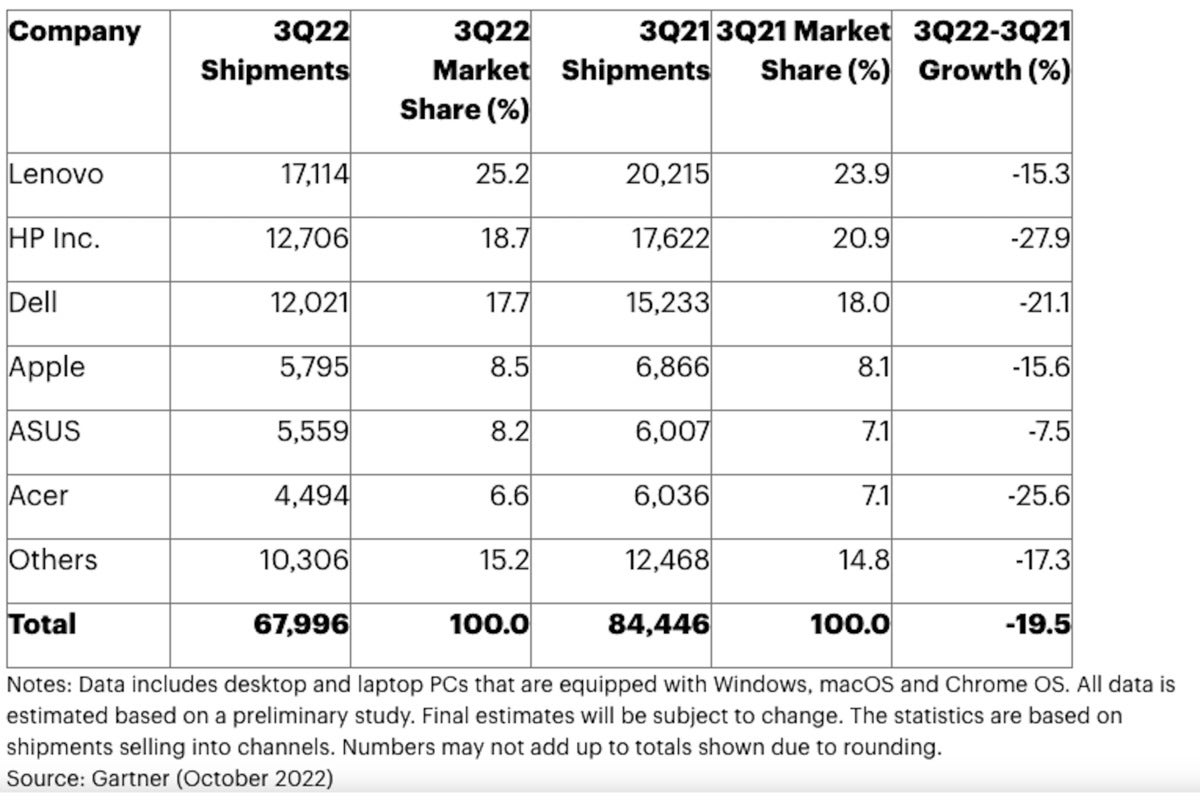

Gartner Inc.

Gartner Inc. Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q22 (Thousands of Units)

The Europe, Middle East and Africa (EMEA) regions were hit particularly hard by plummeting sales, decreasing 26.4% year-over-year in the third quarter to 17 million units -the steepest decline among all regions, according to Gartner. It was the third negative quarter for the EMEA PC market following a boom at the start of the pandemic.

Globally, shipments of PCs totaled 74.3 million, according to IDC. (Gartner pegged global sales of PCs at 67.9 million.)

The top three vendors in the worldwide PC market remained unchanged in the quarter, with Lenovo holding the No. 1 spot in shipments with 25.2% market share, according to Gartner. HP followed with 18.7%, and Dell was third with 17.7% of sales. Apple, Asus and Acer followed with 8.5%, 8.2% and 6.6% of PC sales, according to Gartner.

For Apple, the picture appeared to be a bit brighter. "Consumer demand has remained muted, though promotional activity from the likes of Apple and other players has helped soften the fall and reduce channel inventory by a couple weeks across the board," said Jitesh Ubrani, research manager for the worldwide mobile device trackers at IDC. "Supply has also reacted to the new lows by reducing orders - with Apple being the only exception, as their third quarter supply increased to make up for lost orders stemming from the lockdowns in China during the second quarter."

Windows 11, which recently received its first annual update since being its launch in October 2021, also had no perceivable impact on new PC sales, according to the research firms. Over the past two years, the market was supply constrained, so people were buying PCs regardless of the OS, IDC said.

"Those buyers can now easily upgrade to 11 if they haven't done so already," Ubrani said.

Windows 11 adoption appeared to stall earlier this year. The OS reached an "overall usage" of 19.4% in March, an increase of more than 10% since the beginning of December 2021, according to AdDuple. By August, Windows 11 adoption had reached 23.1% of devices.

"Less than 3.5% of modern Windows PC upgraded to Windows 11 in the last two months. Approximately the same number was added to the latest version of Windows 10," AdDuplex said on its site.

In addition to shipment volumes, IDC said it's keeping a close eye on selling prices. Shortages over the last several years have driven product shipments towards the premium end of the scale, according to Linn Huang, research vice president for IDC's Devices & Displays practice.

"This, coupled with cost increases of components and logistics, drove ASPs [average selling prices] up five quarters in a row to$910 in 1Q22, the highest since 2004," Huang said. "However, with demand slowing, promotions in full swing, and orders being cut, the ASP climb was reversed in 2Q22. Another quarter of ASP declines indicates a market in retreat."

Lenovo gained market share compared to a year ago, although shipments declined year-over-year, Gartner noted. While the company's overall shipments were down in all regions except Canada, the EMEA desktop market saw growth, fueled by production beginning in Lenovo's first in-house manufacturing facility in Europe. That facility opened in Hungary in June.

HP saw a challenging quarter, with a sharp decline in overall global shipments. While it recorded growth in some regions in the desktop market, overall laptop shipments suffered declines.

Dell narrowed its market share difference from HP, recording year-over-year growth in the desktop market in all regions except in Asia Pacific. However, Dell's laptop shipments declined elsewhere, except for Japan.

Горячие метки:

яблоко

Портативные компьютеры

Windows 11

В чем дело?

Hp-hp

Настольные компьютеры

О компании Lenovo

Горячие метки:

яблоко

Портативные компьютеры

Windows 11

В чем дело?

Hp-hp

Настольные компьютеры

О компании Lenovo